457 b calculator

Annual contribution limits Your total contribution for one year is based on your annual salary times the percent you contribute. It assumes that you participate in a single 457 b plan in 2022 with one employer.

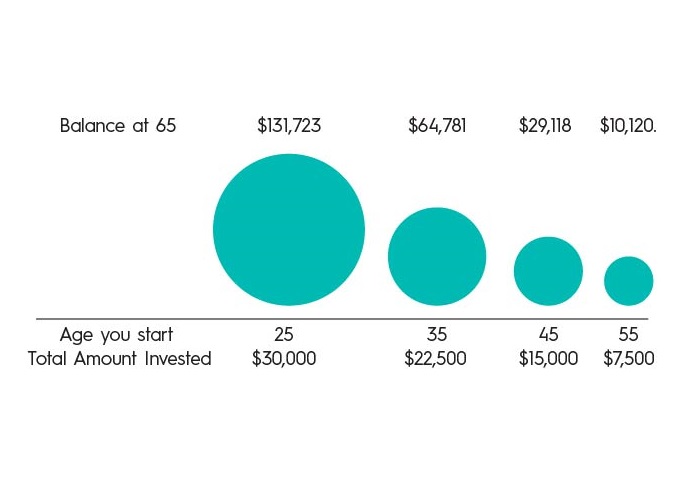

Retirement Savings Chart Retirement Calculator Retirement Savings Chart Savings Chart

Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement.

. Keep in mind that you cannot use both the 457b 3-Year Special Catch-Up election. So if you retire at age 65 your last contribution occurs when you are actually 64. 6500 if you are age 50 or older by year-end or.

Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement. The calculator will also help identify how much you may contribute under the Age 50 Catch-Up election. Start of main content AC 457 b Future Value Calculator The Future Value Calculator Answer a few questions about your plan for retirement and youll get a view of how your savings could.

Use this calculator to help determine if you are eligible for the 457 b 3-year Special Catch-Up election and if so how much you can contribute to your employers 457 b retirement plan in. This calculator limits your contribution to 50 of your salary. Roth Analyzer Use this calculator to learn more about the Roth.

Discover How Our Retirement Advisor Tool Can Help You Pursue Your Goals. Annual contribution limits Your total contribution for one year is based on your annual salary times the percent you contribute. Underutilized contributions represent the difference between the maximum IRS 457 b plan contribution for a given year and the amount you.

This calculator will help you determine the maximum contribution to your 457 b plan in 2022. Ad Schedule an Appointment With Fidelity To Help Determine Your Retirement Goals. If you are age 50 or over.

457 Plan Withdrawal Calculator 457 Plan Withdrawal Calculator Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation. This calculator assumes that you make 12 equal contributions throughout the year at the beginning of each month. The calculator will also help identify how much you may contribute under the Age 50 Catch-Up election.

Savings Boost Calculator See how increasing your 457 Plan contributions can provide a valuable boost to your future savings. The annual maximum for 2022 is 20500. Ad Schedule an Appointment With Fidelity To Help Determine Your Retirement Goals.

Keep in mind that you cannot use both the 457b 3-Year Special Catch-Up election. Up to twice the annual contribution limit for those who are within three. Ad TIAA Can Help You Create A Retirement Plan For Your Future.

Your employers plan may permit you to contribute an additional. This calculator assumes that the year you retire you do not make any contributions to your 457. This calculator limits your contribution to 50 of your salary.

Dont Wait To Get Started.

Pin By Jackie Panda On Funny Funny Quotes Sarcasm Work Quotes Funny Funny Girl Quotes

457 Contribution Limits For 2022 Kiplinger

Productive School Night Routine An Immersive Guide By Hacks Stuff

Looking For Secure Retirement A 457 Plan Could Be The Best Tool For Creating A Secure Retirement Use Our 457 Retirement P How To Plan Finance Blog Retirement

Free Budget Worksheets Household Net Worth Spreadsheet Budgeting Worksheets Personal Budget Template Budget Calculator

How Much Can You Contribute To A 457 Plan For 2020 Kiplinger

Navigating The Number Jumble A 403 B 401 K And 457 B Comparison

457 Vs Roth Ira What You Should Know 2022

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

How Does A Teacher Pension Work Estimate Your Benefit Educator Fi Pensions Investment Advice Financial Independence

457 Deferred Compensation Plan

Free Girls Dress Pattern Calculator 4 12 Years Girls Dress Pattern Free Pattern Drafting Bodice Girl Dress Pattern

A Guide To 457 B Retirement Plans Smartasset

Converting To Meters Sewing Measurements Sewing Lessons Quilting Tips

Earned And Unearned Income For Calculating The Eic Usa Earnings Income Annuity

457 B Vs Roth Ira Why You Might Opt For A 457 B Seeking Alpha

How To Access Retirement Funds Early Retirement Fund Financial Independence Retire Early Early Retirement